By Blue Horizon and Synonym

Biomanufacturing – the production of food ingredients and other materials via microorganisms, continues to establish itself as a promising building block for a more sustainable, healthier, and resilient economy – the bioeconomy.

We have come a long way already in terms of optimized performance of strains, continued government investment and increasing commercial awareness of bioproducts. Yet an important next step in establishing our bioeconomy is to scale-up the bio-manufacturing of food and materials to industrial volumes, enabling competitive pricing against animal and petroleum-based counterparts.

New York-based developer of biomanufacturing infrastructure, Synonym, is helping the sector to do exactly that. Working at the intersection of finance, policy, development and engineering, Synonym and their tools are critical in driving the transition to a biology-based future.

Synonym at a glance

In November 2022, Blue Horizon partnered with Synonym, the Good Food Institute, and the Material Innovation Initiative with the common goal of connecting biology innovators with the capacity to manufacture products at scale. Capacitor (www.capacitor.bio) became the world’s first comprehensive and free database of microbial fermentation capacity.

In February 2023, Synonym aggregated and anonymized data from Capacitor to release a first-of-its kind report, titled the ‘State of Global Fermentation Capacity,’ revealing the latest trends in microbial fermentation capacity and details on the types of available facilities by geography, bioreactor sizes, product expertise, and more.

Synonym launched Scaler (www.scaler.bio) in June 2023, a free, online, and interactive techno-economic analysis (TEA) engine, allowing synthetic biology companies to project costs of production and operation and understand levels of commercial adoption.

And now, a year on from our initial partnership, Synonym released a refreshed and even more detailed edition of the ‘State of Global Fermentation’ report, extracting data from both Capacitor and Scaler to shed light on the scope and diversity of global fermentation capacity today.

So, what’s new?

Say hello to nearly 100 new facilities!

Nearly 100 new facilities were added to Capacitor between now and the release of the original State of Global Fermentation Capacity back in February 2023 – meaning Capacitor increased its overall facility count by 68%.

Scaler has experienced equally impressive user engagement since its launch in July 2023, with 350+ companies generating 2000+ reports and modelling over 100 products – a positive sign of the increasing dialogue around biomanufacturing capacity!

246 facilities in total– but where is all this capacity?

Capacitor now features 246 fermentation facilities, which are distributed over 40 countries.

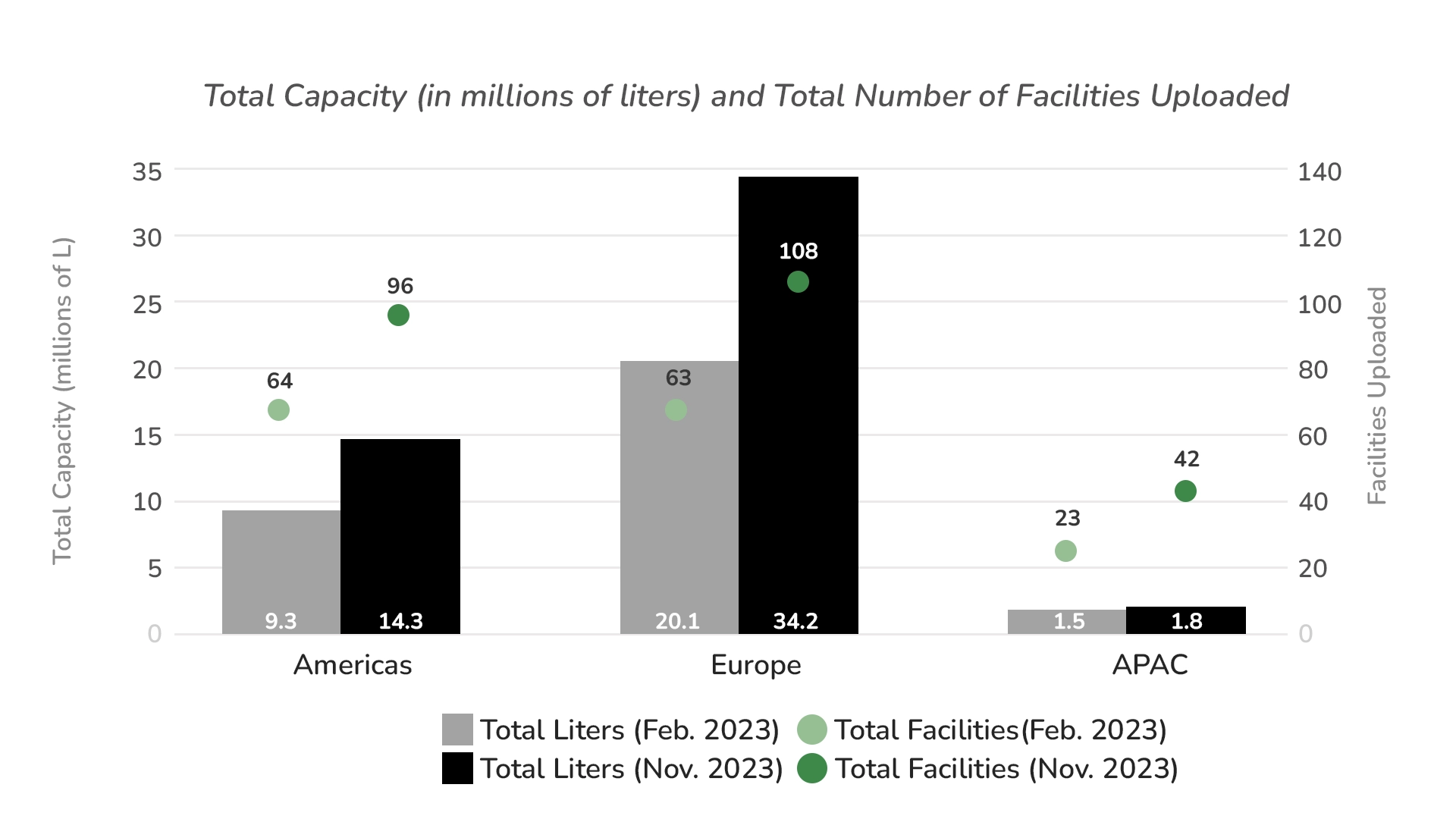

Cataloged capacity has increased in all tracked regions, reflecting both increased use of the Capacitor tool and new facilities becoming available. Notably, Europe maintained its lead in offering most of this capacity, with 108 facilities providing ~34.2 million L – an impressive increase of 14 million L from February 2023. The Americas are also home to a significant amount of capacity, with 96 facilities providing ~14.3 million L. Meanwhile, APAC and its 42 facilities provide ~1.8 million L of capacity, an increase of 300,000 L from February 2023.

Yet still, the appetite for capacity far exceeds supply

Industry demand for capacity (as seen on Scaler) and actual fermentation capacity (as modeled on Capacitor) are far from aligned.

In fact, if every company using Scaler looked for a facility to match their largest modeled capacity need, we would need an additional 595 million liters of available capacity to serve the market. This is ten times the capacity available on Capacitor today!

A mismatch between facility scale and user demand

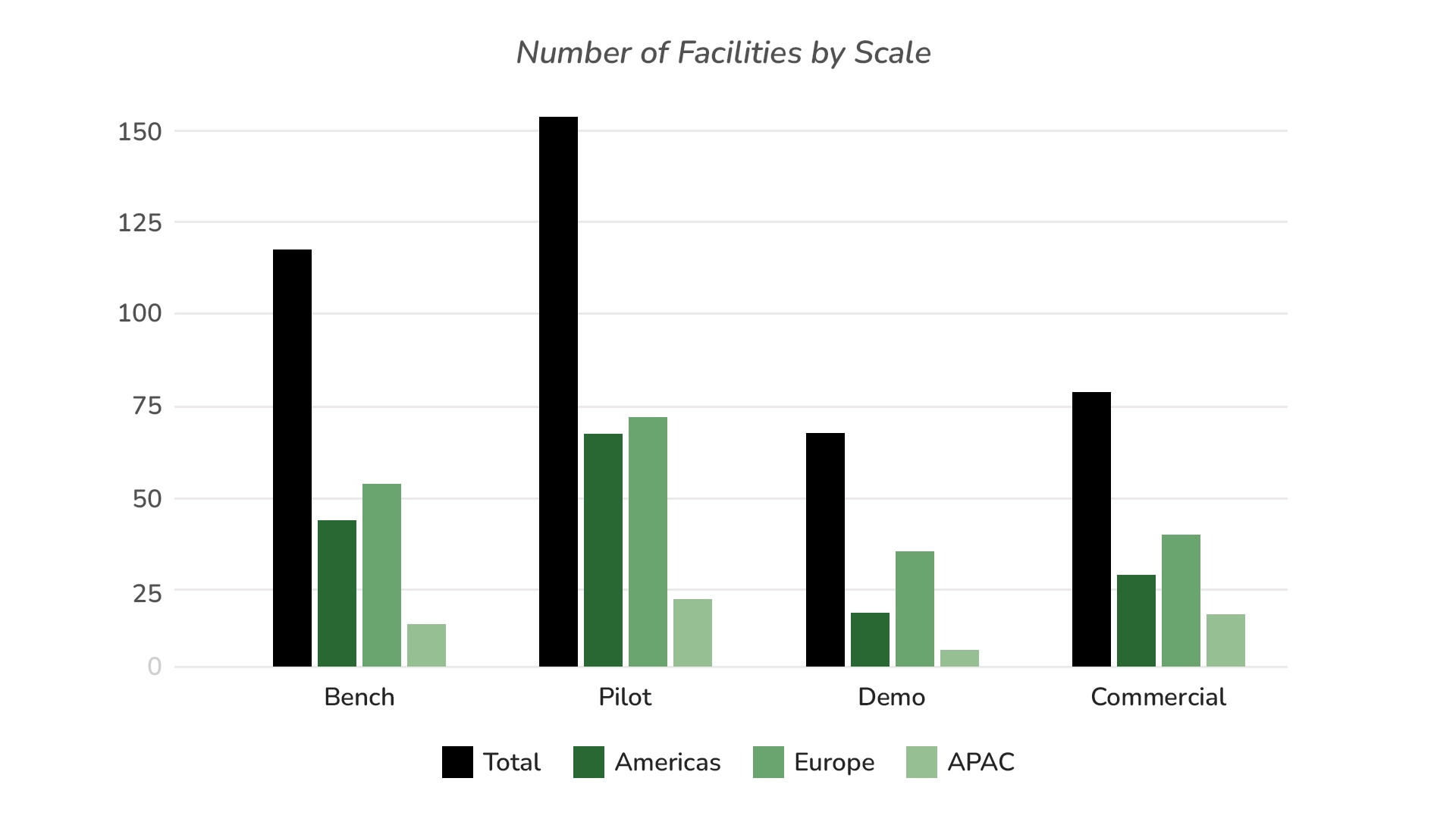

This lack of capacity to serve the market becomes clearer when taking a closer look at the number of facilities by scale (capacity).

The median total capacity need modeled by companies on Scaler was 900,000 L, signaling clear demand for larger-scale (moderate to commercial-sized sized) facilities for companies to reach commercial production.

Yet as the size of bioreactors increase, the number of facilities that have available fermenters decreases substantially. There are only 20 facilities with tanks on Capacitor greater than 100,000 L for true commercial operations.

It is therefore safe to say that most fermentation facilities are focusing on smaller capabilities with activities targeted at bench (48%) and pilot-scale (64%), while comparatively few are focusing on demo (28%) and commercial-scale (34%) operations.

With more than half (~59%) of users filtering for bioreactors larger than 20,000 L and less than 25% of Capacitor facilities having bioreactors larger than this size, there is a clear shortfall of facilities offering the big bioreactors that producers need to get their products onto the mass market at a price of parity to their traditional counterparts.

Scale is not the only way to achieve price parity with animal-counterpart products

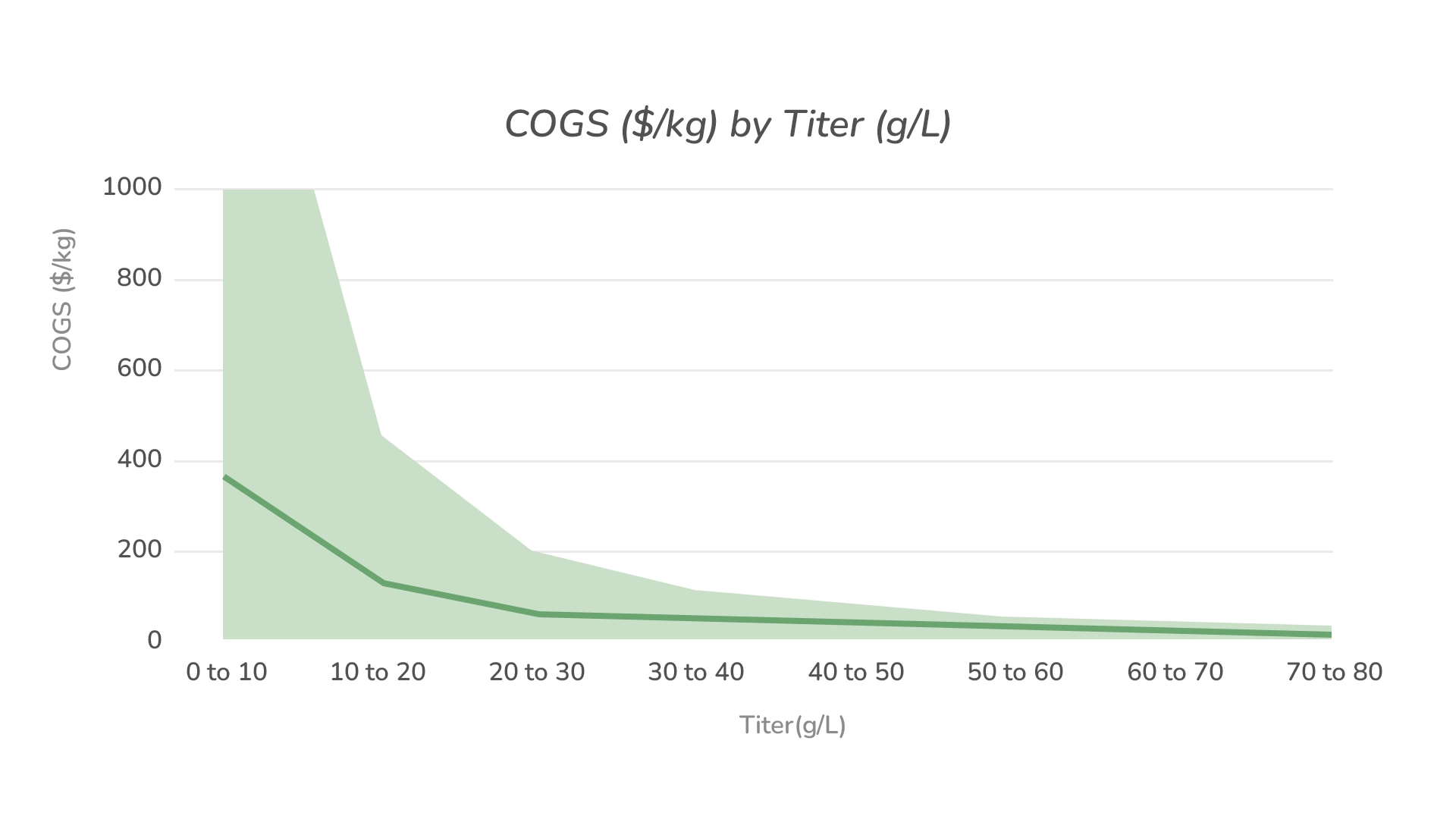

Scaler data confirms that scale is indeed a quick way to reduce COGS (cost of goods sold) and drive economics, as every 2x increase in scale (capacity) reduced COGS by 1.4x. However, technology improvements were better yet.

Titer (a measurement of product concentration) proved to be a more impactful parameter, with significant cost compression occurring as titers increased. With a 2x increase in titer, COGS were cut by 2x (on a $/kg of product basis).

This suggests that facilities should increasingly focus on strain development and technology improvement activities to reduce costs. Only focusing on scale may leave facilities vulnerable against competitors who are also innovating for higher yields, either through strain development, process improvements, or recovery rates.

To support such technological advancements, facility providers or companies looking to build their own infrastructure, should keep flexible facility designs front and center of mind. This way they can cater to the high performing strains.

Product expertise is harmonized

Data shows that real harmony exists between the types of products companies want to bring to market and the production capabilities of the facilities. For instance, the top three products that users are filtering for are proteins, recombinant proteins, and enzymes – which also are the most supported products that uploaded facilities manufacture.

Going forward – future-proofed facilities and collaboration

While not all facilities can accommodate every user due to the unique requirements of different processes – we see that nearly half of processes still share common needs and characteristics, particularly in downstream processing (DSP) and upstream fermentation systems. These commonalities make it feasible to design standard facilities, which can serve companies without significantly increasing costs.

That being said, with the newfound importance of technology improvements in reducing costs, flexible facility designs that are “compatible with the high performing microbial strains of tomorrow are critical to ensure that equipment investments today don’t become stranded assets tomorrow.”

Lastly, building the bioeconomy of the future calls for a collective effort. With significant improvements in infrastructure, technical performance, and the optimization of facility design and operations, we can reap the environmental, societal, and economic benefits associated with a biology-based future.

Download the full report here: https://capacitor.bio/trends

For any questions on Capacitor, Scaler, or the insights presented here, please don’t hesitate to get in touch with the Synonym team at contact@synonym.bio