By Blue Horizon and Synonym

In November 2022, Blue Horizon partnered with Synonym, the Good Food Institute, and the Material Innovation Initiative to release Capacitor (www.capacitor.bio), the world’s first comprehensive and free database of microbial fermentation capacity. One thing led to another – and invaluable data from Capacitor prompted the release of the ‘State of Global Fermentation Capacity’, a first-of-its kind report revealing the latest trends in microbial fermentation capacity and details on the types of available facilities by geography, bioreactor sizes, product expertise, and more.

It is an exciting time for the biomanufacturing sector, especially given the breakthrough results for climate change, human health, and animal welfare it can achieve if the right tools and infrastructure are in place. In recent years, synbio companies have received billions of dollars in investment, and their innovations are vital in aiding the development of a more resilient, adaptable, and sustainable global industrial economy.

Harnessing the Full Potential of the Bioeconomy

To unleash the full potential of these synbio innovations, we need an established network of large-scale infrastructure to drive commercial adoption – so together with Synonym, we made it our goal to connect biology innovators with the capacity to manufacture products at scale. In a previous project, we outlined strategic approaches to building scalable bioeconomy businesses.With Capacitor, we set out to help the ecosystem better understand the current supply and demand for microbial fermentation capacity gaps and in doing so identified the major infrastructure gaps that need to be addressed if we want to unlock the full potential of the bioeconomy as a building block for a greener global economy.

1,000+ Registered Users, 187 Facilities across 39 Countries

The database acts as a new, valuable information source on types of facilities by geography, bioreactor sizes, product expertise and more. Capacitor documents 150+ facilities listed in over 30+ countries and pinpoints the available bench-scale, pilot-scale, and commercial scale fermentation capacity for a variety of products, including, enzymes, proteins, probiotics and many more.

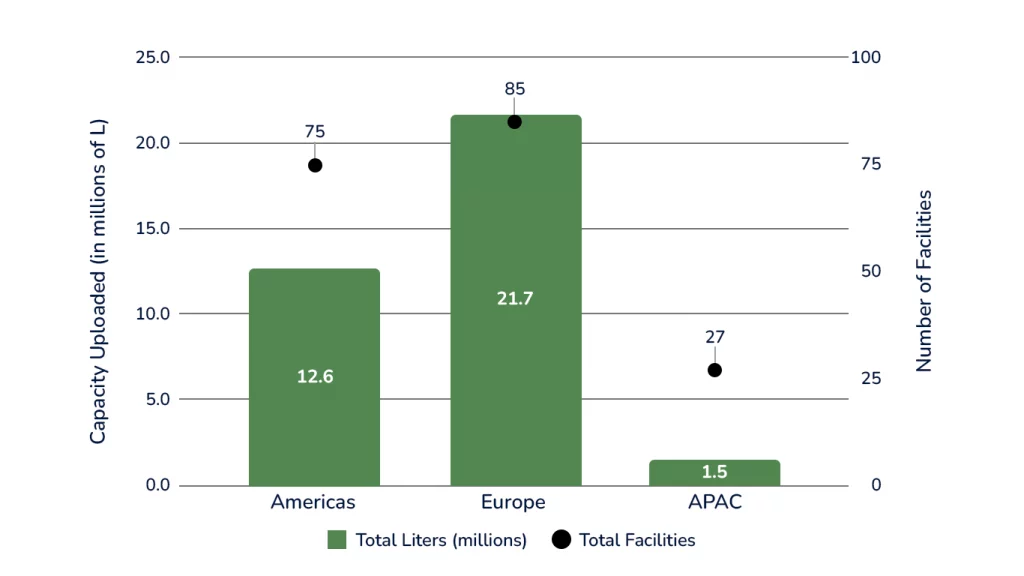

Let’s get to the data. We see that the most capacity listed on Capacitor is in Europe, with ~21.7 million liters uploaded across 85 facilities. In the Americas ~12.6 million liters of capacity has been uploaded across 75 facilities. Despite having a similar number of facilities, Europe clearly leads the way in terms of capacity scale, managing an additional ~9.1 million liters. In APAC, only ~1.5 million liters has been uploaded across 27 facilities, but this is set to rise as biomanufacturing matures and CDMOs are established in the region.

Exhibit 1: Number of Facilities per Region and Capacity Uploaded per Region

So, the good news is that over 36 million liters of fermentation capacity is already listed globally, meaning a lot of fermentation capacity already exists today – but it looks like users are on the hunt for technological facilities that don’t fully match the capacity already available. For example, less than 50% of facilities offer chromatography, ultra/microfiltration, or spray drying.

Commercial-Scale Facilities Are In Highest-Demand

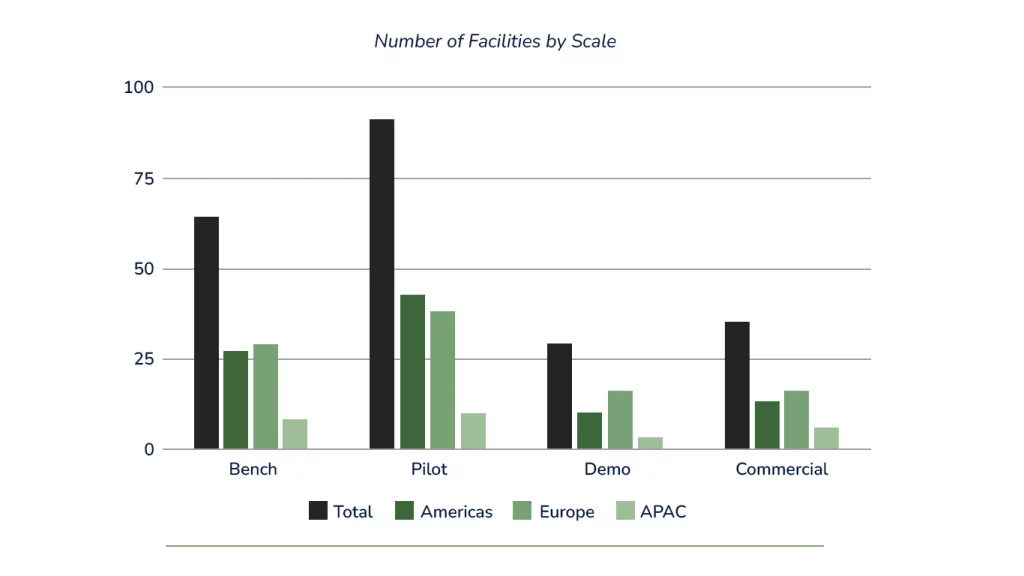

Facility scale data reveals that most available facilities are bench-scale (29%) or pilot scale (41%), with far fewer demo-scale (15%) and commercial-scale (16%) facilities. This is great news for startups entering the space, who only require smaller-scale capacity, but the majority of users are now searching for commercial-scale or demo-scale facilities, with the main shortage of biomanufacturing capacity at 20,000L+ scale.

This just goes to show that the network of large-scale infrastructure needed to achieve commercial adoption does not yet exist.

Exhibit 2 – Facility Scale: Number of Facilities by Scale

The Way Forward

It’s clear from the data that capacity is an issue for the bioeconomy space, and larger capacities with bigger bioreactors will be crucial in enabling companies to manufacture sufficient quantities needed to reach cost parity with legacy animal-derived or petroleum-based products.

So, how do we get there? Many synbio companies, contract manufacturing organisations and governments spanning a variety of geographies and sectors are now working to address the capacity shortage. This is great to see, as fostering the bioeconomy will certainly be an international, cross-sectoral and public-private effort.

Fermentation facilities come at quite a cost – which is where smart-financing schemes, investors and governments play an important role in easing the bottleneck. Government support may take the form of low-interest loans, non-dilutive investments, tax rebates, or direct subsidies to fund careers in the broader bioeconomy space.

Co-manufacturers and developers will also be more important than ever. They are crucial partners for companies who need to refine their process and prove initial market traction before investing into their own plant.

Start-ups are also recommended to leverage partnerships in their scale-up efforts. We see this occurring more and more often, with recent examples including AB InBev and The Every Co, as well as Cargill and Enough among others.